As the calendar turns, the real estate landscape in the Pacific Northwest continues to evolve. Whether you are a first-time homebuyer looking to plant roots near Lacamas Lake, a veteran utilizing your benefits in Vancouver, or a homeowner in Prune Hill considering a refinance, success in the 2026 housing market requires strategy, foresight, and local expertise.

At Jeff Wen Mortgage Broker Inc., we believe that the best mortgage isn’t just about the lowest rate on a specific day—it’s about how that mortgage fits into your long-term financial health. This comprehensive guide serves as your roadmap for mortgage planning in 2026, tailored specifically for residents of Camas, Washougal, and the greater Clark County area.

Why 2026 Requires a Strategic Approach to Home Financing

The days of impulsive home buying are behind us. The market in 2026 is defined by nuance. While inventory in Camas and Vancouver is stabilizing, competition for high-quality homes remains fierce. Furthermore, interest rate volatility requires borrowers to be nimble and well-prepared.

Planning ahead allows you to:

- Lock in favorable terms: Understanding market triggers helps you time your lock.

- Strengthen your buying power: Cleaning up credit and reducing debt-to-income (DTI) ratios takes time.

- Compete effectively: Sellers in the Pacific Northwest prefer buyers with solid, local pre-approvals over generic online pre-qualifications.

Step 1: Assessing Your Financial Health

Before you start browsing listings in downtown Camas, you need a clear picture of your financial standing. A mortgage is likely the largest debt you will carry, and lenders will scrutinize the “Three C’s”: Capacity, Credit, and Collateral.

Reviewing Your Credit Profile

Your credit score is the gatekeeper to the best interest rates. In 2026, credit scoring models have become more sophisticated. It is not just about paying bills on time; it is about credit utilization and the mix of credit types.

Action Item: Pull your credit report at least 3 to 6 months before you plan to buy. If you see errors or high utilization, contact Jeff Wen immediately. As a specialized mortgage broker, we can run

“what-if” simulators to show you exactly which debts to pay down to boost your score.

Calculating Your Real Budget

Don’t rely solely on online calculators. They often miss critical local factors like Camas property taxes (which can vary by district), homeowner’s insurance rates in wooded areas, and HOA fees.

Step 2: The Camas & Vancouver Housing Market Outlook for 2026

Real estate is hyper-local. What is happening nationally often does not reflect the reality in Clark County, WA. Here is what we are seeing on the ground:

Inventory Trends

Camas continues to be a destination for families seeking top-rated schools and outdoor access. We are seeing a “flight to quality,” where updated homes sell quickly, while fixer-uppers sit longer. This presents an opportunity for buyers willing to utilize renovation loans or 203k products.

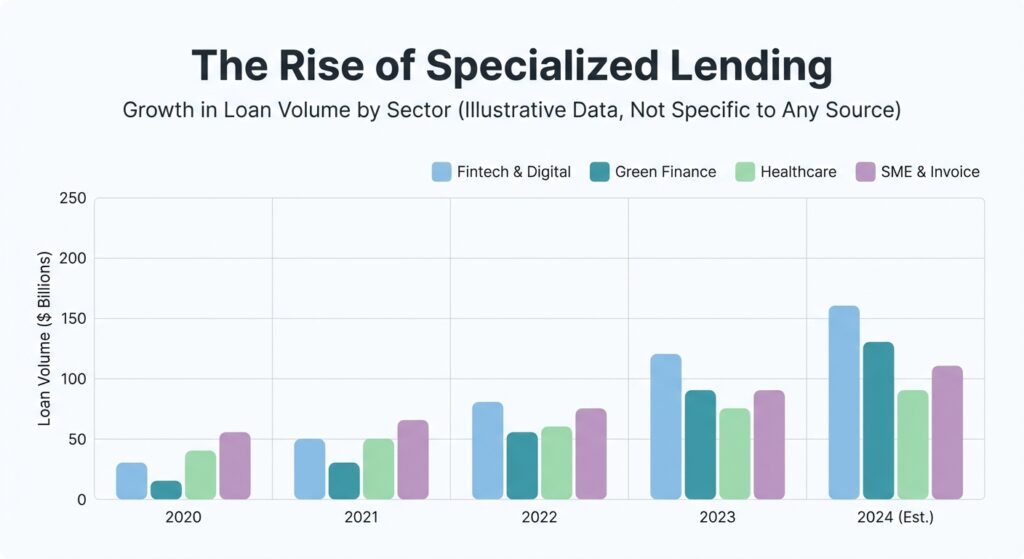

The Rise of Specialized Lending

As we noted in our recent report regarding the Rising Necessity of Local Specialized Lenders for VA Loans in Vancouver, WA, generalist lenders often struggle with the complexities of our local market. Whether it is navigating VA residual income requirements or understanding the unique appraisal aspects of rural properties in Washougal, working with a local specialist is crucial.

Step 3: Choosing the Right Loan Program

One size does not fit all. In 2026, the menu of mortgage options has expanded. Here is a comparison of the most common loan types we structure for our clients:

Loan Program Comparison Table

| Loan Type | Ideal For | Down Payment | Credit Score Req. | Key Benefit |

| Conventional | Borrowers with | As low as 3% | Typically 620+ | Flexible terms; no |

| VA Loan | Veterans, Active | 0% | Flexible (often 580+) | No PMI; competitive |

| FHA Loan | First-time buyers or | 3.5% | 580+ (for 3.5% | More forgiving on |

| Jumbo Loan | Luxury homes in | 10-20% | Typically 700+ | Allows financing for |

Note: Requirements can vary based on the specific lender and market conditions in 2026. Contact Jeff Wen Mortgage Broker Inc. for a personalized quote.

Step 4: The Pre-Approval Advantage

A pre-approval letter from Jeff Wen Mortgage Broker Inc. carries weight. Listing agents in Camas and Portland know that when we issue a pre-approval, the vetting process has been thorough.

To get pre-approved for your 2026 purchase, gather the following documents:

- Two years of W-2s and tax returns.

- 30 days of pay stubs.

- Two months of bank statements (all pages).

- ID and proof of residency.

Pro Tip: If you are self-employed or have variable income, start this process early. We specialize in helping business owners navigate mortgage qualification.

Refinancing in 2026: Is It Time?

- Lower your monthly payment: Improve cash flow.

- Shorten your term: Switch from a 30-year to a 15-year mortgage to build equity faster.

- Cash-out equity: Use the appreciation of your Camas home to fund renovations, pay off high-interest debt, or invest.

- Remove Mortgage Insurance: If your home value has risen, you might be able to eliminate PMI without a new appraisal in some cases.

Why Choose a Local Camas Broker Over a Big Bank?

In an era of automated call centers and chatbots, local expertise is your greatest asset. Here is why clients in Camas and Vancouver choose Jeff Wen:

- Accessibility: You can reach Jeff directly at 19498736488 or via email at [email protected]. You are not just a file number.

- Speed: We understand that the local market moves fast. We work efficiently to meet tight closing dates.

- Specialized Knowledge: From VA loans to complex investment property financing, we understand the nuances that generic lenders miss.

- Community Focus: We live here, we work here, and we are invested in the success of our neighbors.

Frequently Asked Questions (FAQs)

1. How early should I start the mortgage process if I want to buy in 2026?

We recommend starting the conversation at least 3 to 6 months before you intend to buy. This gives us ample time to correct any credit issues, optimize your down payment strategy, and ensure you are fully pre-approved when the right home hits the market.

2. Are mortgage rates expected to drop in 2026?

While we cannot predict the future with 100% certainty, most economic indicators suggest a stabilizing environment. However, waiting for the “perfect” rate can often cost you more in home appreciation. The best strategy is to buy when you are financially ready and refinance later if rates drop significantly.

3. I am a Veteran in Vancouver, WA. Why should I use a specialized VA lender?

VA loans have specific requirements regarding residual income and property conditions. Generalist lenders often misunderstand these guidelines, leading to unnecessary delays or denials. A specialized local lender ensures your benefits are maximized and the process is smooth.

4. What is the difference between Pre-Qualification and Pre-Approval?

Pre-qualification is a rough estimate based on self-reported data. Pre-approval is a verified commitment to lend based on a review of your financial documents. In the competitive Camas market, a pre-approval is essential to having your offer considered.

5. Can I buy a home in Camas with a low down payment?

Absolutely. Programs like FHA loans require only 3.5% down, and Conventional loans can go as low as 3% for first-time buyers. VA loans and USDA loans (in eligible rural areas) offer 0% down payment options for qualified borrowers.

Ready to Build Your 2026 Mortgage Roadmap?

Whether you are looking to buy your dream home in Camas, invest in Vancouver real estate, or refinance your current mortgage, the path to success starts with a plan. Don’t navigate the 2026 housing market alone.